Boost Your Savings with Rates up to 4.00% APY

GIVE YOUR SAVINGS A BOOST.

Explore Boost for great high-yield savings rates from popular banks and credit unions

Enjoy a rate multiples above the national average and know your money is federally insured*

Use our easy calculators to see your savings potential with today’s high interest rates

High-yield savings accounts offer higher interest rates compared to traditional savings accounts, enabling your savings to grow more rapidly over time. This growth is advantageous for short-term financial goals or building an emergency fund.

In addition to attractive interest rates, high-yield savings accounts typically come with minimal fees and low or no minimum balance requirements, making them accessible to a wide range of savers. Most offer flexibility and easy access to funds without penalties. Moreover, these accounts are generally insured by the FDIC or NCUA up to the maximum allowed, ensuring that your money is protected. This security, higher returns, and flexibility make high-yield savings accounts an excellent choice for individuals looking to maximize their savings potential without exposing themselves to significant risk.

Savings Calculators

See your potential earnings

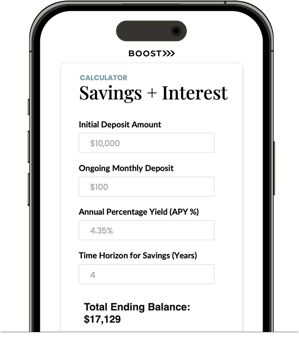

Savings + Interest

Learn how much you can earn with the power of compound interest

Certificate of Deposit

Discover how the guaranteed return of a CD can grow your funds

Savings Goal

Saving for something? See how much you need to save monthly to get there

Featured Article:

Popular Boost Knowledge Hub Articles

All featured companies offer FDIC or NCUA insurance up to the maximum allowed by federal law.

Advertising Disclosure: We may earn a commission if you open an account with a featured company. Not all companies or offers are listed. Compare rates, fees, and terms before deciding.